Xero Makes 1099 Reporting Beautiful with New Integration

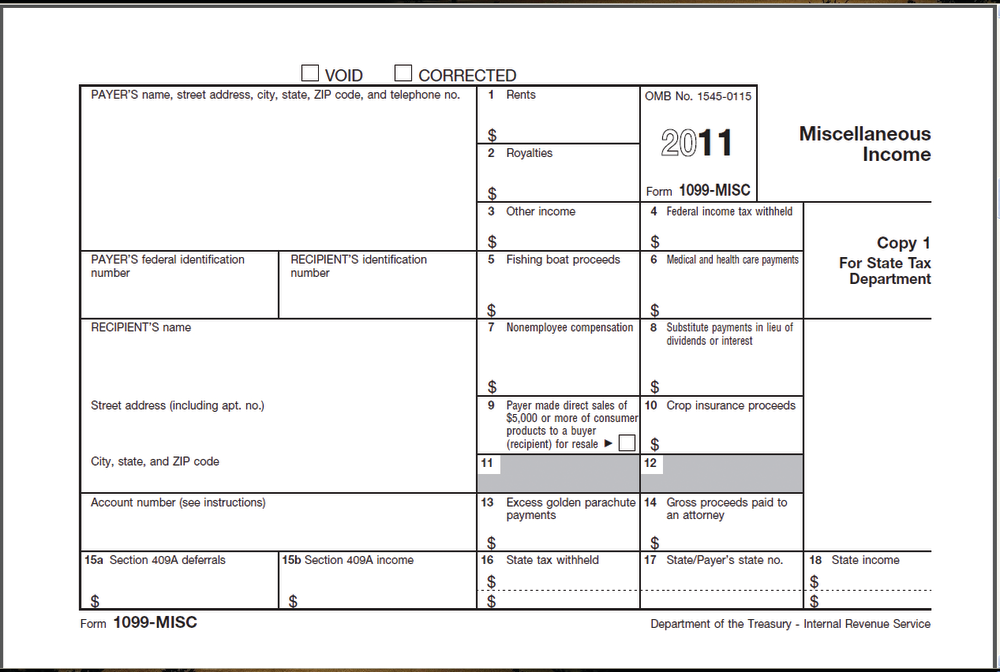

Xero announced today it will integrate with Track1099, in efforts to help small business owners handle the increasing number of 1099 forms they must prepare and file.

Dec. 10, 2012

Xero announced today it will integrate with Track1099, in efforts to help small business owners handle the increasing number of 1099 forms they must prepare and file. Xero provides online accounting software for small businesses and their advisors.

According to a report published earlier this year by EMSI, the number of self-employed workers has increased 14.4 percent to 10.6 million since 2001. This rise has led more small business owners to turn to the self-employed workforce for their services. As a result, small business owners and their accountants are preparing and filing even more 1099s. By integrating with Track1099, Xero is helping to streamline this process. The integration will allow for automation of 1099 form data. Users can electronically complete the forms with three options for filing with the IRS – mail, email and e-filing. Xero also supports exporting to CSV format for other accounting software.

“Small businesses asked and we delivered. The 1099 feature has been beautifully designed to make filing a breeze through Xero’s online accounting platform,” said Jamie Sutherland, Xero, President of U.S. Operations. “And with Track1099, both business owners and accounting professionals can file online minimizing the cost and time-consuming workload associated with 1099s.”

In addition to the 1099 integration, Xero is now offering IFRS and GAAP compliant reports. The default reporting standard can be set for users’ country of origin and accountants can use both reporting standards with Xero’s Partner Edition. Additional new features include email templates, payment terms, auto-reversing manual journals and outstanding statements.

“I can’t wait for Xero’s 1099 features, which I expect will cut the time I spend on this process in half, and give me more time to focus on coaching and advising my clients on their financial health,” says Ean Murphy, Business Owner, Moxie Bookkeeping, “Integration with Track1099 will replace what has previously been a massively manual job that business owners dreaded, and that can cost a significant amount in fees.”

Xero’s 1099 preparation features will help increase efficiency for those business owners who do not have completely automated processes, especially when it comes to 1099s, added Murphy.

“We heard our customers loud and clear – 1099s are a major headache for small businesses,” said Sutherland. “We stepped back and took a look at the entire process to see how Xero could help ease that burden as the number of self-employed workers continue to grow.”