BNA Software – BNA Sales & Use Tax Rates and Forms

Sep. 05, 2014

800-424-2938

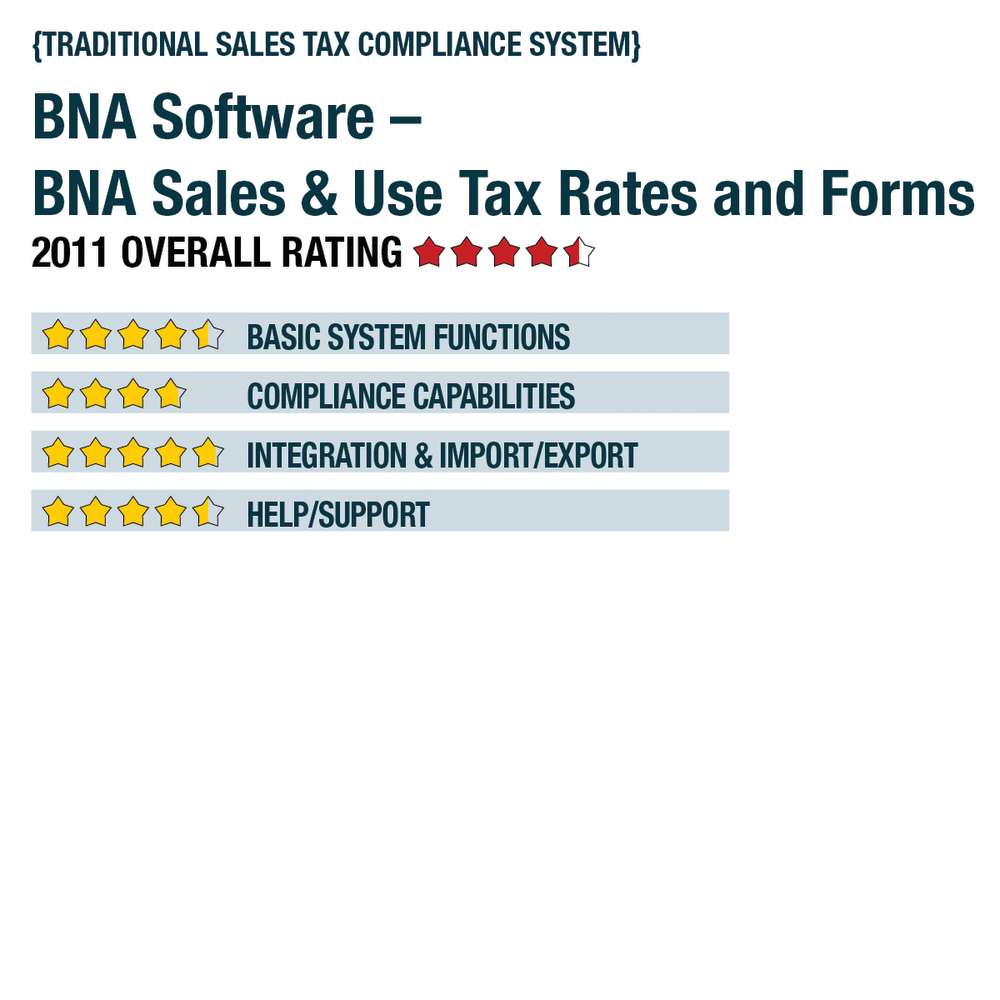

2011 Overall Rating 4.5

Best Fit:

Mid-sized and larger businesses with growing SALT compliance complexity, and firms managing compliance for multiple entities. Also businesses wanting comprehensive tax tables for export into their live sales and accounting systems.

Strengths:

- Very easy-to-use

- Comprehensive: All U.S. jurisdictions

- PDF, Excel, XML, CSV, Text output

- Multi-client management tools

- Schedulable rate table export feature

- Web-based delivery means easy access and no updating

Potential Limitations:

- Rate lookup and form preparation not integrated

- No e-filing or electronic payment options

Executive Summary & Pricing

The two components of BNA Sales & Use Tax Rates and Forms Online (the forms preparation and rate lookup utility) are easy to learn and use, and provide comprehensive compliance support that includes all taxing jurisdictions in the United States. The program does not offer e-filing or electronic payment of sales and use tax returns, but can be used in preparation of forms that are then submitted online via a state website. The system is best designed for mid-sized and larger businesses with multiple locations or varying nexus definitions that require compliance with multiple jurisdictions. Its ability to manage any number of business entities also makes it a good selection for firms managing these compliance processes for multiple entities. Pricing is $925 per year for unlimited access and use of both the forms preparation and rate lookup systems.

Product Delivery Methods:

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 4.5

Compliance Capabilities 3.75

Integration/Import/Export 4.75

Help/Support 4.5