Tax Planning

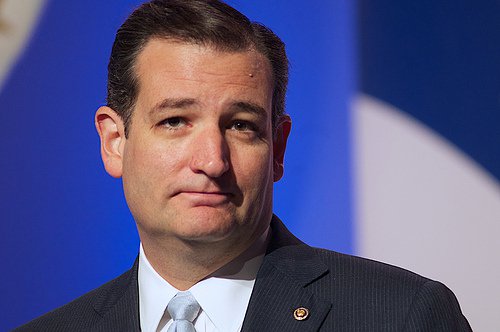

Ted Cruz’s Income Tax Plan Shakes up the Status Quo

According to most media reports, Senator Ted Cruz (Rep.-TX) was one of the “winners” in the Republican presidential debate held on October 28. At the very least, the radical tax plan released by Cruz just prior to the debate tip-off is generating ...

Oct. 30, 2015

According to most media reports, Senator Ted Cruz (Rep.-TX) was one of the “winners” in the Republican presidential debate held on October 28. At the very least, the radical tax plan released by Cruz just prior to the debate tip-off is generating plenty of buzz.

Significantly, Cruz would institute a flat income tax rate of 10 percent and eliminate payroll taxes, replace the current corporate tax rate structure with a flat 16 percent rate, repeal the alternative minimum tax (AMT) and the taxes under the Affordable Care Act (ACA) – legislation he wants to completely scrap – and wipe estate taxes off the face of the earth for good. Among other dramatic proposals, the Texas senator would provide a universal savings account with no strings attached and abolish the IRS.

During the debate, Cruz bragged that the 10 percent flat rate proposal is the lowest on record. Previously, Sen. Rand Paul (Rep.-KY) had proposed a 14.5 rate. Cruz’s tax plan was initially released to the Wall Street Journal and details can now be found on his website at https://www.tedcruz.org/tax_plan.

Here are some of the key components of Cruz’s tax plan unveiled on the presidential candidate’s website.

- Flat income tax: The simple flat tax would eliminate the graduated rate structure. The current seven-tier system for individuals would “collapse” into a single, low rate with a10 percent with a standard deduction will be $10,000. The personal exemption will be $4,000, the same as the rate for 2015 returns. Under this method, the first $36,000 of income for a family of four would be tax-free. Certain other tax breaks — including the Child Tax Credit, the Earned Income Tax Credit (EITC) and deductions for charitable contributions and mortgage interest — would remain place.

- Payroll taxes: As part and parcel of the flat tax rate, Cruz would completely eliminate payroll taxes in order to boost jobs and wages for working Americans. Cruz claims that funding for Social Security and Medicare would be guaranteed.

- Corporate income tax: The plan effectively repeals the corporate income tax system – now featuring a top tax rate of 35 percent — and replaces it with a simplified business flat tax of 16 percent. The tax would be based on revenue minus expenses such as equipment, computers and other business investments.

- Universal savings accounts (USAs): This would be a new saving device available to American taxpayers from all walks of life. An individual would be able to save up to $25,000 annually on a tax-deferred basis and use the funds for any purpose. – no questions asked.

- Estate tax: The “permanent” estate tax provisions in the tax code would be eliminated forever. (Previously, the estate tax was repealed in 2010 before being reinstated after just one year.) Cruz emphasizes that small businesses and farms that would have been sold outside the family to pay death taxes could be spared.

The pre-election year proposals made by Cruz may appeal to both individuals and the business sector, but concerns remain about the potential impact on tax revenue. According to the Tax Foundation, a conservative-leaning independent organization, the plan would cost $3.6 trillion in tax revenue over the next decade. Based on employment incentives, gross domestic product (GDP) would increase by 13.9 percent, translating into 12.2 percent higher wages and 4.8 million new full-time equivalent jobs. After accounting for these factors, the Tax Foundation figures the plan would reduce tax revenue by $768 billion.