Accounting

Trial Balance In QuickBooks Online Accountant Eliminates Double Work

Accountants spend a considerable amount of time cleaning up books at the end of the year, manually entering data and preparing returns for clients. Recognizing this, Intuit has developed Trial Balance within QBOA to help eliminate manual data entry.

Dec. 21, 2015

One of the largest inefficiencies during tax season for accounting professionals is processing and preparing business tax returns. They spend a considerable amount of time cleaning up books at the end of the year, exporting trial balances to make adjustments and then manually entering that data into their tax solution. Most of the data entry accounting professionals perform already exists in their books and they are entering the same data multiple times. Recognizing this, Intuit has developed and released Trial Balance within QuickBooks Online Accountant, designed to help eliminate manual data import, export and entry work.

The release of Trial Balance builds on last year’s introduction of Books-To-Tax and will accelerate the year-end review process, safeguard accountants’ work and eliminate manual data entry.

“On average, accountants spend roughly five-and-a-half hours checking for errors, working in multiple apps and performing manual data entry. Last year, I spoke with accountants who use Books-to-Tax and they told me they saved an average of one hour per client during the tax season. With Trial Balance, our goal is to save a target of two-and-a-half hours per client,” said Tom Palfreyman, Senior Product Manager, Intuit.

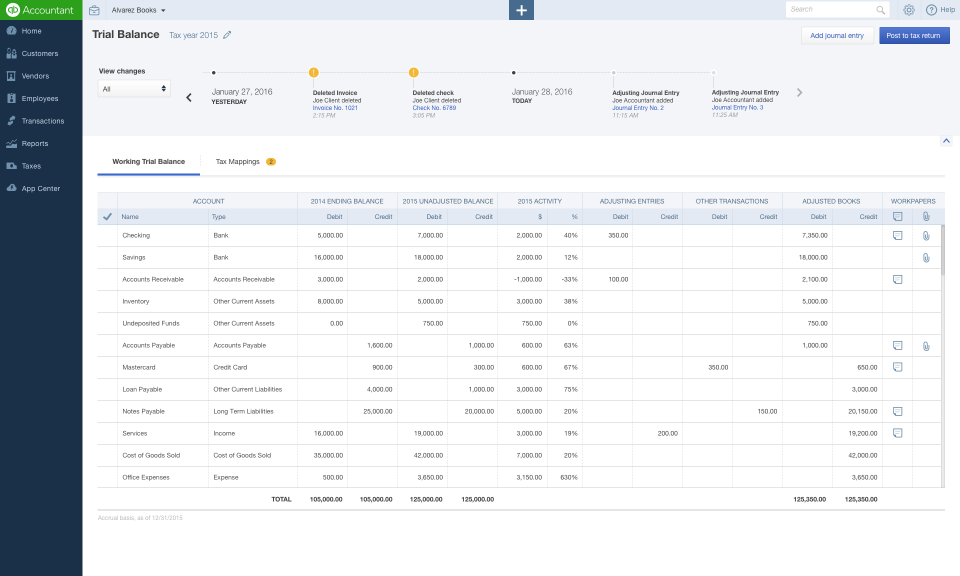

Trial Balance, which is only accessible to accountants, was designed to sit on top of QuickBooks Online Accountant, giving users one-click access to the data and information they need. One of the first things users will notice in the QBOA dashboard is a new Trial Balance column. New users will be prompted to start a new review. Once trial balance has been set up, you can always access it with one click by selecting “Continue Review.”

Features within Trial Balance include an Activity Timeline, the capability to create notes, document attachments and Intuit Tax Online integration. Once a review has been started, the Activity Timeline shows client and accountant activities that impact the client’s balance, and will alert users to any changes that have been made since the last time Trial Balance was accessed. Accountants can also view year-over-year variances and quickly identify any adjustments that need to be made. Any adjustment and reclassification activity will be displayed in the Trial Balance view, accessible at any time. Trial Balance will also place an automatic date and time stamp on completed reviews, along with the name of the user that completed the review. Any work that is performed will be saved to the review and can be accessed later by the user or others within the firm. All notes, attachments and the Trial Balance worksheet will be saved under one login.

QuickBooks Online integrates into Intuit Tax Online and tax mappings allow users to access chart data from tax destinations within Intuit Tax. The software uses the terminology found on the tax forms, simplifying and streamlining the preparation process. Users can edit tax lines within the software and even select transactions to map to the tax return. Accountants can choose to post data directly to clients’ tax returns or removed mapped transactions.

Additionally, if the user has a prior-year Intuit Tax Online return, they can choose to carry-over the prior-year’s ending balances so that the balance sheet is auto-populated with “Beginning of tax year” and “End of tax year” totals. Once the tax return has been prepared, users can review the return for accuracy and completeness before filing within the program. Trial Balance also lets users export their accounts and balances to either Excel or a CSV format, allowing them to import the finished balances into their tax application.

Trial Balance is available now for free to all QuickBooks Online Accountant customers through the QuickBooks Online Accountant Client Dashboard. Additional abilities, such as saving all reports to a .zip file and refreshing all trial balance work, will be rolled out soon. Non-paying customers are able to use the Trial Balance-Intuit Tax Online tool as many times as they want for free before filing. They will not be prompted to pay until they go to e-file the return. QuickBooks Online Accountant customers will be able to file two free business returns and five free individual returns (with a Schedule C) using the trial balance feature.