Accounting

2020 Review of GMS Grant Management System

Apr. 16, 2020

![desktop-screen-generic-accounting_11_orig[1]](/wp-content/uploads/sites/2/2020/04/desktop_screen_generic_accounting_11_orig_1_.5e8384afdf267.png)

GMS Software

Grants Management Systems

800-933-3501

From the April 2020 reviews of nonprofit accounting systems.

GMS Accounting and Financial Management/Reporting System is designed for nonprofits and public organizations that need a specialized accounting application to better manage contracts, funds, and grants.

GMS is designed to be deployed on-premise, although there are specifications available to have the application hosted on the cloud.

GMS offers a 5-digit general ledger code that is used to track assets, liabilities, revenue, expenses, and equity. For more in-depth tracking, users can utilize 6-digit program elements, which are designed to track program or grant details, including cost centers, activities, and components.

Although it is designed to track program and grant funds, GMS is also able to handle other types of transactions, including journal entries, cash disbursements, cash receipts, and limited document management. In addition, GMS also offers a variety of add-on features and functions called supplements that integrate with the core GMS modules. Supplements available include Timesheet import, New Hire Reporting, Direct Deposit, as well as supplements for A/P, A/R, and Financial Reporting.

GMS offers five types of budgets: Program Budgets, Indirect Cost Budgets, Fringe Benefit Budgets, YTD Timesheet Budgets, and an Agencywide Budget. Program Budgets are the most common type of budget used in GMS and are designed to be entered for the entire grant or contract period. The Agencywide Budget functions as an organizational budget, and is frequently used to compare fiscal year-to-date revenues and expenses.

Although it is an excellent option for organizations that are funded primarily from grants, GMS is not designed for organizations that actively accept donations or need to raise funds, with no available options for either available in the application. GMS also offers basic allocations such as leave, fringe benefits, and indirect costs, and also offers a variety of add-on allocation options including internal and external year-to-date base allocations, monthly allocations, and a variety of allocation reporting options. Other add-on allocation supplements include Shift Indirect Costs, Cost Allocation Locks, and Monthly Cost Center Allocations.

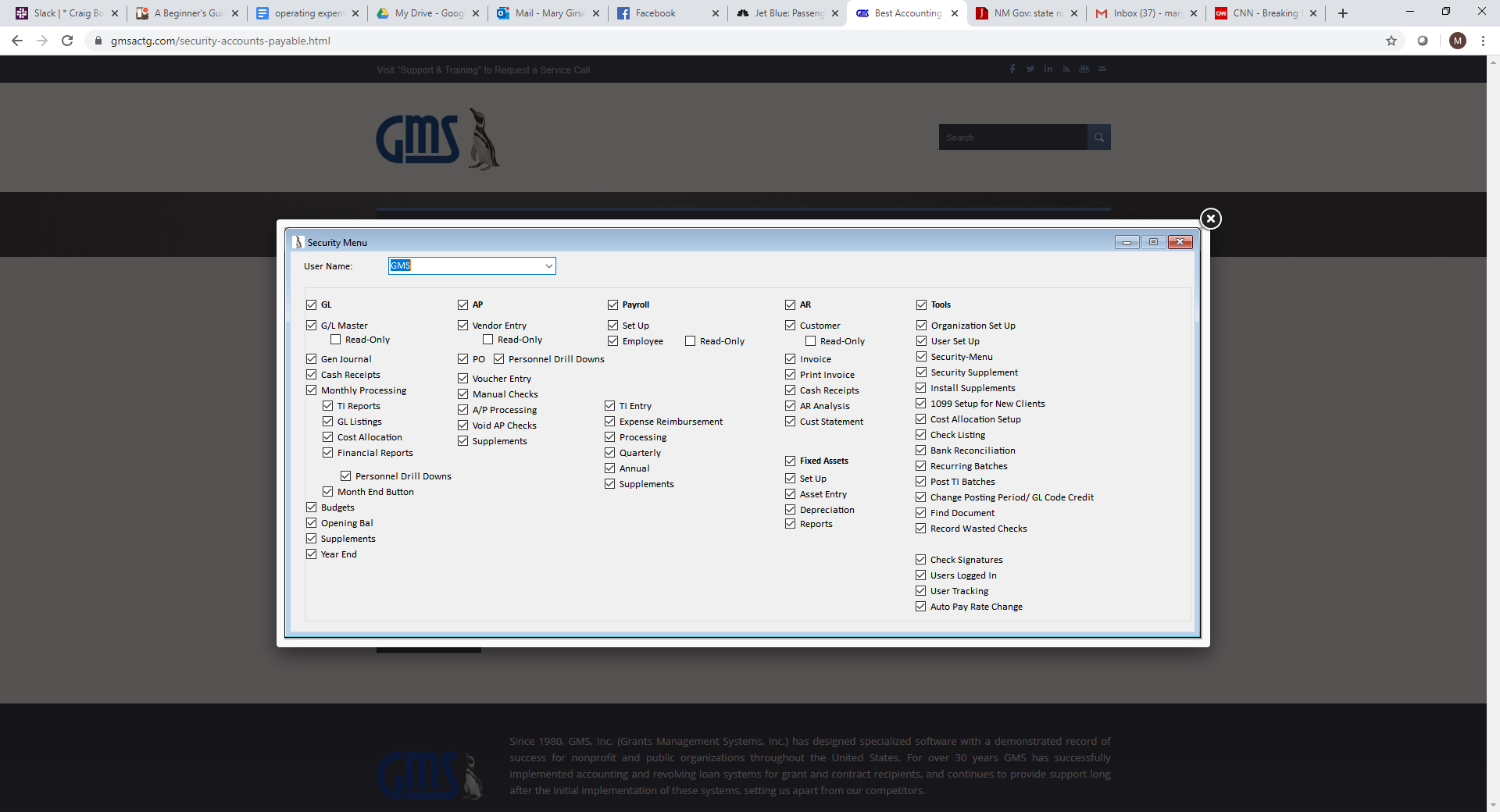

GMS includes multi-level security, with admins able to assign system access individually or add a new user to a group with similar access needs.

System access can also be assigned by module or by tool, with users able to set up specific rights within each module. Read-only rights can be assigned to those who need access to system reports but are not authorized to add, edit, or delete existing data.

System access can also be assigned by module or by tool, with users able to set up specific rights within each module. Read-only rights can be assigned to those who need access to system reports but are not authorized to add, edit, or delete existing data.

GMS offers decent reporting options, with several standard report options available in the application including General Ledger Activities, Timesheet Reporting and Labor Distribution, Cost Allocation, and Financial Reporting. Available reports include Project Element Charge Listing, Balance Sheet, Revenues and Expenditures by Program Element, Revenues and Expenditures by Project, Indirect Cost Rate Computation and Analysis, and Year-to-Date Allocation Summary. An optional Report Writer and a R & E Report Designer supplement are also available for those who wish to create custom reports. All GMS reports are created as a PDF, making it easy to share reports via email, but more difficult to customize.

GMS’s core application includes GL, Cash Receipts, General Journal, Budget Preparation, Cost Allocation, AP, Payroll, Timesheet Accounting, Financial Reporting, and security features. Additional functionality is available from the long list of add-on supplements that can be purchased separately, with all supplements designed to integrate with the core application.

Third-party integration in GMS is limited to importing and exporting files via Microsoft Word, Excel, or by using a CSV format. In addition, users can export reports to Crystal Reports if desired.

The GMS Client Portal offers complete account management for all users, including access to system downloads and updates. In addition, users can request a service call, chat with a service and support specialist, and order supplements from the client portal as well. New users are required to purchase the GMS Telephone and Training package, with approximately 3-6 hours of training suggested. Other training options are available via GMS University, which includes webinars as well as local training options.

GMS is designed for nonprofits and public agencies that need to manage multiple grants, funds, or contracts. Pricing for GMS is based on the number of system users, with pricing available directly from GMS. In addition, GMS offers a variety of add-on supplements in a variety of categories including payroll, financial reporting, accounts payable, accounts receivable, and cost allocation, with all supplements priced separately.

2020 Rating – 4.5 Stars

Strengths:

· Strong fund/grant management

· Good selection of modules

· Long list of add-on supplements

Potential Limitations:

· No donor management or fundraising features available

· No cloud version available

· Difficult to customize reports

· Limited third party integration

· Chart of accounts not customizable