Payroll

2020 Review of AMS 1099 Forms Filer/Payroll

Oct. 14, 2020

![amslogo3[1]](/wp-content/uploads/sites/2/2020/10/amslogo3_1_.5f7394c009535.png)

AMS Payroll – 1099 Forms Filer/Payroll

Advanced Micro Solutions

800-536-1099

From the 2020 reviews of professional payroll systems.

AMS Payroll/1099 Forms Filer/Payroll (AMS Payroll) from Advanced Micro Solutions is an add-on module that is designed to work with W-2/1099 Forms Filer. Though AMS Payroll also works with other AMS applications, it cannot be used as a stand-alone payroll application.

All AMS applications are best suited for small to mid-sized businesses, with AMS Payroll supporting up to 1,999 payers and up to 9,999 employees per payer, making it a good option for firms processing payroll for multiple clients, although its on-premise only structure may not be suitable for some firms.

AMS Payroll can be purchased directly from the AMS website, with users able to download the application immediately. There is not a cloud version of the application available, nor is there a mobile app that can be used with the application.

AMS Payroll offers both live and after-the-fact payroll processing, with payroll available in all 50 states, the District of Columbia, and Puerto Rico.

Upon accessing AMS Payroll, users will need to complete the payer setup process which includes an option to enter federal deposit information as well as various pay rates, and details on authorized users. There are additional setup options available as well including state and local tax information as well as numerous user defined fields that can be used to track additional information.

AMS Payroll supports up to six different pay rates with three miscellaneous rates per employee. For businesses with multiple payers, users will need to select a payer in order to access the general menu, where various payroll options such as Module, Deposits, and Reports are available.

AMS Payroll offers up to 30 different check types, and offers direct deposit capability as well. All standard deductions can be managed in AMS Payroll, which also tracks standard payroll data such as overtime, holiday, and vacation pay, with up to 40 user-defined fields available to track just about any information desired. There is also an option to suppress pay rates and social security numbers on checks.

AMS allows the employer to withhold from multiple states, however, it will only allow processing of one state return per employee.

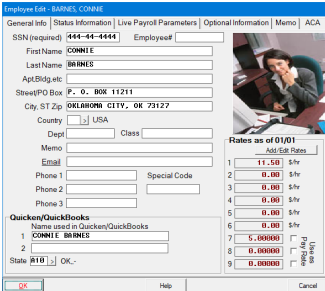

Click for larger image: The Employee Edit screen lets users add employee details including a photo.

AMS Payroll provides basic reporting options. The application offers federal payroll tax forms including 941, 940, and 943, and also offers electronic reporting of year-end tax forms. In addition, AMS Payroll will automatically export year-end payroll information directly to AMS W-2/1099 for processing. AMS Payroll also includes SUI forms for all 50 states, the District of Columbia and Puerto Rico, and will also electronically file quarterly state tax returns for 29 states.

In addition to being an add-on module that should be used with AMS W-2/1099 Forms Filer, AMS Payroll also integrates with other related AMS modules which include 1042-Filer, ACA Filer, e-Filer, Direct, Forms Filer Plus and Software Generated Forms. AMS Payroll can import data from a variety of third-party applications including QuickBooks Desktop and Sage 50cloud, and also integrates with Microsoft Excel. In addition, the application can import and convert data from other applications as well, although there are no available integrations with timekeeping applications.

AMS handles both current and after-the-fact payroll but does not offer any HR tools at this time.

AMS Payroll includes a downloadable electronic manual, with current users able to download product updates directly from the AMS website as well. Users can also access the FAQ page, the Support Knowledge Base, and Form Instructions and Publications directly from the website. Product support is available during regular business hours with support available by phone, or by completing a support request from the vendor website.

The current price for AMS Payroll is $129, with the required W-2/Forms Filer module running $129 as well. That flat fee, and annual updates, can be used to manage payrolls for any number of businesses. All software can be immediately downloaded once purchased, with a free demo available for those that wish to try out the application prior to purchasing.

2020 Overall Rating – 4.25 Stars

Strengths:

- Affordably priced

- Integrates with QuickBooks, Sage 50cloud, Excel

- Specific versions available for Restaurant, Farm, Nanny, Caregiver, Household Employee, Construction, and Church and Nonprofit

Potential Limitations:

- Only available as an on-premise application

- Users need to purchase multiple AMS applications for complete functionality

- No mobile application

- No portal

- No custom reporting

- No access to paystubs or W-2 forms

- No HR tools