Benefits

2020 Review of OnPay Payroll

Oct. 14, 2020

OnPay

877-328-6505

From the 2020 reviews of professional payroll systems.

OnPay is a cloud-based payroll application well-suited for small businesses, although the product is fully equipped to run payroll for up to 500 employees. OnPay also offers partner pricing for accountants, with free payroll available for the firm, and discounts increasing as additional clients are added. In addition, any firm currently using QuickBooks or Xero will receive expert help with the setup and integration process.

OnPay Payroll offers full-service payroll, which is easily accessible from any computer. The application also includes a mobile app for both iOS and Android devices, with all payroll features available on the mobile app.

OnPay offers a variety of features including unlimited pay runs, and offers users the choice to pay employees via a check, debit card, or direct deposit. OnPay includes payroll for all 50 states and handles all tax filings and payments. Multi-state payroll is supported in the application as are both multiple pay rates and schedules. OnPay also pays contract employees, can handle garnishments, and includes a complete employee self-service option that allows employees to handle their own onboarding, access both current and historic paystubs, and manage all of their payroll related forms including W-4s as well as any voluntary payroll deductions for benefits offered. OnPay also includes complete PTO management, with users able to create custom PTO policies, with the application automatically tracking PTO totals. In addition, OnPay offers payroll options for niche industries such as restaurants, nonprofits, and agricultural workers. The product also processes year-end W-2s and 1099s.

For companies migrating from another payroll system, OnPay will assist in migrating all employee data if desired.

Both the standard payroll and the accountant’s payroll offer a user dashboard, with the accountant’s dashboard enabling users to view all of their clients from a single location. The standard dashboard in OnPay is completely customizable, with all system features easily accessible from the vertical menu bar at the left of the screen. In addition, the dashboard also includes other handy features such as a task list, a list of recent payroll runs, and when the next payroll is scheduled to be run.

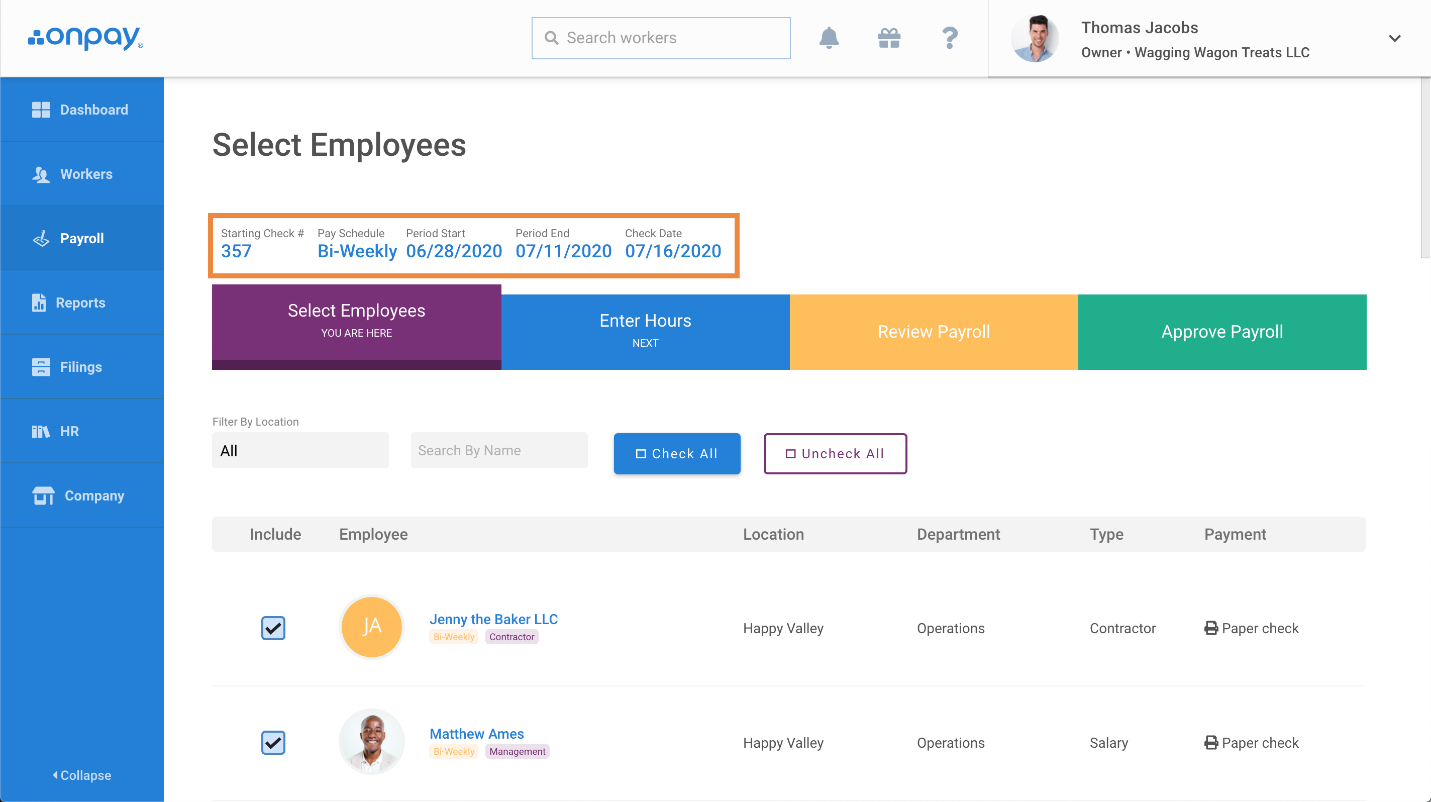

Click for larger image: The Select Employees screen lets users easily view and select employees to be paid.

OnPay includes tax tables for all 50 states, with all appropriate taxes withheld and remitted to the appropriate tax authority, along with required forms such as Form 940 and 941.

OnPay includes more than 40 standard payroll reports including a Payroll Listing, Payroll Summary, and Payroll Register. A Check Detail report and Earnings Summary report are also available in the application. All tax related reports are created and filed by OnPay, with users able to access the reports at any time. All reports can be customized as needed, with users able to export reports to Microsoft Excel for further customization or save any report as a PDF.

OnPay offers integration with a variety of third-party applications including accounting applications such as QuickBooks Online, QuickBooks Desktop, and Xero. OnPay also integrates with timekeeping applications such as TSheets, Deputy, When I Work, and Humanity, as well as Think HR for access to HR advice, tools and HR related documents templates, and PosterElite, which provides payroll and labor-related posters to keep companies in compliance. OnPay also includes integrated workers’ comp options as well as 401(k) plan administration.

OnPay includes excellent HR capability which is included with the core payroll application with offer letters, new state hiring reporting, online management of I-9s and W-4 forms, custom personnel checklists, and built-in HR document templates among the HR features available. New employees can handle their own onboarding through the employee self-service option, with managers creating a list of tasks for an employee to complete by a specific date.

The OnPay Help Center offers users access to a variety of resources including Payroll, Tax Resources, HR, Benefits and Compliance, and Accountants and Bookkeepers. The help center also provides access to trending articles and includes a searchable knowledgebase with allows users to search for help in a specific area. In addition, OnPay offers Payroll, HR, and Benefit specific articles and resources designed to help small businesses. Toll-free product is available from OnPay, with chat support available as well.

OnPay is well-suited for small businesses looking for a all-inclusive payroll and HR solution that is also affordably priced. Currently, OnPay’s base fee is $36 per month, with a $4 per person/per month fee assessed. Accounting firms partnering with OnPay will receive a 10% discount for more than two clients, with the firm’s payroll provided at no cost. A free-30-day trial is also available to those that wish to try out OnPay prior to purchasing.

2020 Overall Rating – 5 Stars

Strengths:

- Includes payroll and HR at one inclusive price

- Offers one plan at one price

- Suitable for up to 500 employees

Potential Limitations:

- Does not offer an auto-pay option

- No after-the-fact payroll available