Firm Management

Audit Partners Are Hopeful Inflation Will Be Less Painful

Most audit leaders have an unfavorable view of the U.S. economy over the next year, according to a CAQ survey.

Nov. 16, 2022

Despite most audit partners’ fears that the U.S. economy will be crummy over the next year, they are cautiously optimistic that inflation will ease in the coming months, according to the Fall 2022 Audit Partner Pulse Survey from the Center for Audit Quality.

Of the 648 audit partners who participated in the survey last month, 73% expect price increases and 68% expect inflation to persist for the next 12 months. However, inflation concerns decreased by seven points since audit partners were surveyed by the CAQ last spring, with 28% of respondents saying the high inflation will last just six to 12 months.

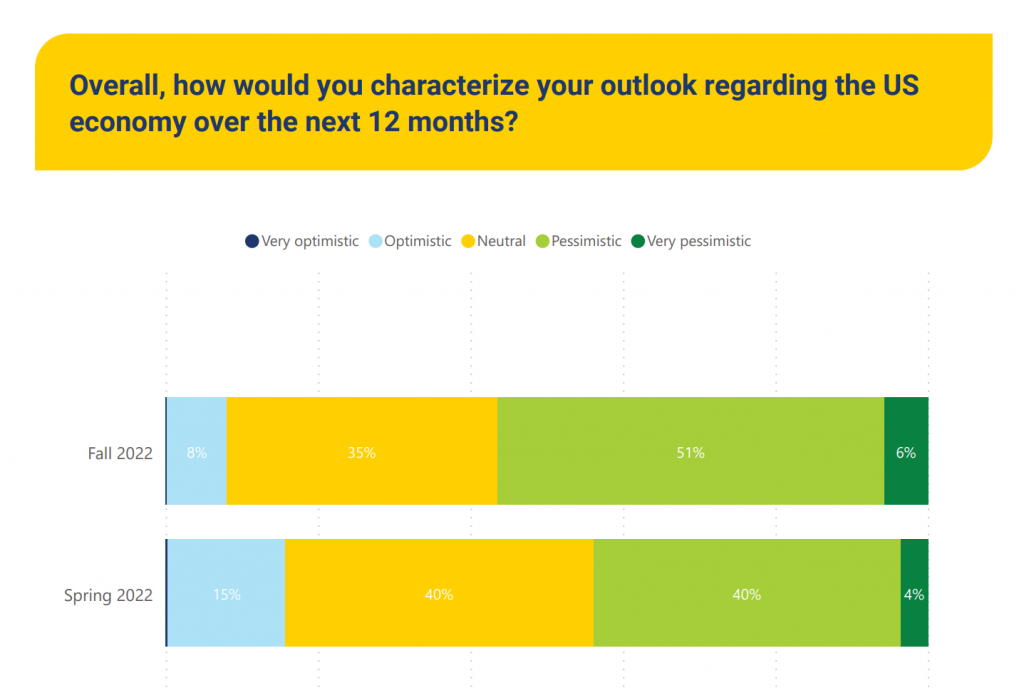

Overall, though, a majority of audit partners (57%) have a pessimistic or very pessimistic view of the U.S. economy for the next 12 months, a 13-point increase since last spring.

That pessimism is likely being driven by a few huge economic risks impacting U.S. businesses, according to the CAQ:

The audit partners surveyed categorized inflation (75%), labor shortages (48%), and supply chain impacts (44%) as the top three risks affecting US companies. Although estimates for how long the inflationary cycle will last have decreased since the spring, concern about its impact on businesses increased by 12 points in the fall survey. At the same time, while still a top-three risk, labor shortage concerns decreased by five points.

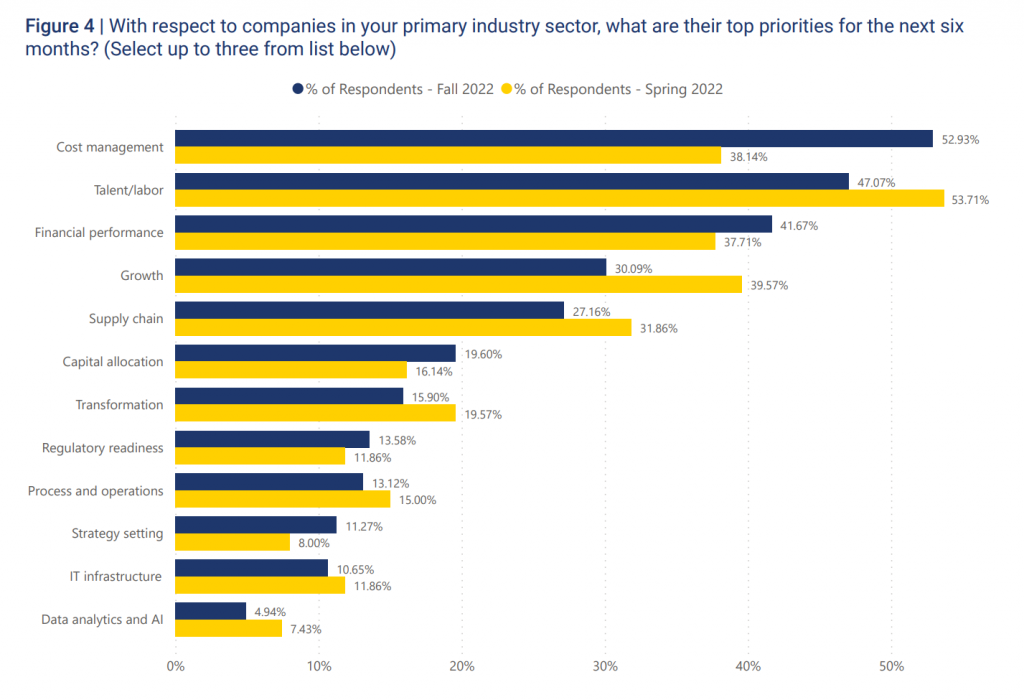

The state of the economy appears to have affected business leader focus areas. Although audit partners indicated that cost management (53%) remains a top priority, focus on talent/labor and growth decreased, while focus on financial performance increased.

“With ongoing concerns about inflation and a potential recession, it’s no surprise that business leaders are re-examining their growth strategies,” CAQ CEO Julie Bell Lindsay said in a written statement. “But the ways they’re adjusting, including throttling back on mergers and acquisitions and scaling back on hiring, stood out to us and suggest that cash flow is a top priority, at least in the short term.”

While hiring might be put on the back burner for some, talent retention is still an important issue for all—now and in the months ahead. According to the survey, audit partners say firms are using the following strategies to retain employees: increasing workplace flexibility (66%), raising compensation (62%), upskilling their professionals (32%), expanding employee benefits (25%).

Respondents also said nearly 22% of companies in their primary industry sector are reducing headcount, up from 8% in the spring, and 19% are increasing headcount, down from 28% last spring.

Audit partners also reported that public company leaders are taking several other factors into account when developing their corporate strategies, including resource scarcity (86%), emerging technology (63%), and climate change (59%).

Fraud risk is also heightened, according to the CAQ, and public companies continue to be proactive in their efforts to deter and detect fraud. Top actions include increased use of technology (63%), updated internal controls (50%), and a heightened focus on fraud deterrence by audit committees (40%).