IRS

CPA; CoFounder and VP New River Innovation

Phone: (336) 542-5705

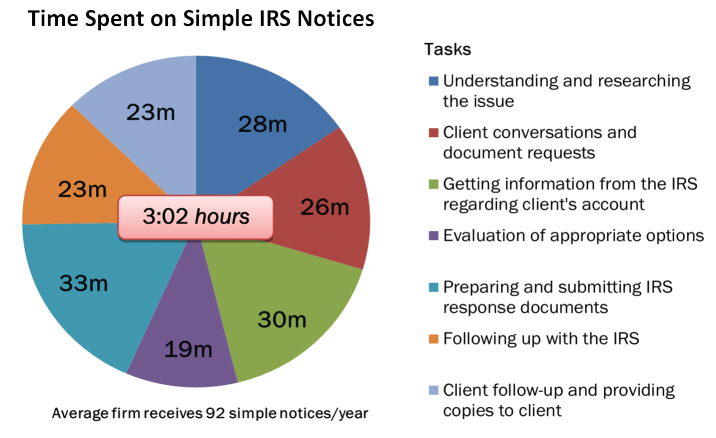

Jim Buttonow, CPA, CITP—Jim is Vice President of Product Development and Cofounder of the tax technology company New River Innovation. Jim's professional mission is to apply emerging technology to problems faced by tax professionals after they file. Jim is a CPA and former IRS Large Case Team Audit Coordinator. He worked at the IRS for 19 years. Since leaving the IRS, Jim has represented many clients before the IRS. At New River Innovation, Jim is the chief architect of Beyond415 (Beyond415.com), an award-winning technology for tax practitioners to efficiently handle IRS issues, notices and audits. Through Beyond415, Jim also develops and presents CPE series on IRS practice and procedure for issues that arise after filing, such as audits, notices and discrepancies. Jim regularly speaks on compliance trends and post-filing practice efficiency strategies for CPA and accounting firms. Jim’s articles and blog posts have appeared in TheWall Street Journal, CPA Practice Advisor, Journal of Accountancy, Accounting Today, and various state CPA society magazines.

IRS

Payroll

Accounting

Accounting

Firm Management

Auditing

IRS

Advisory

IRS

Accounting

IRS

Technology