Benefits

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

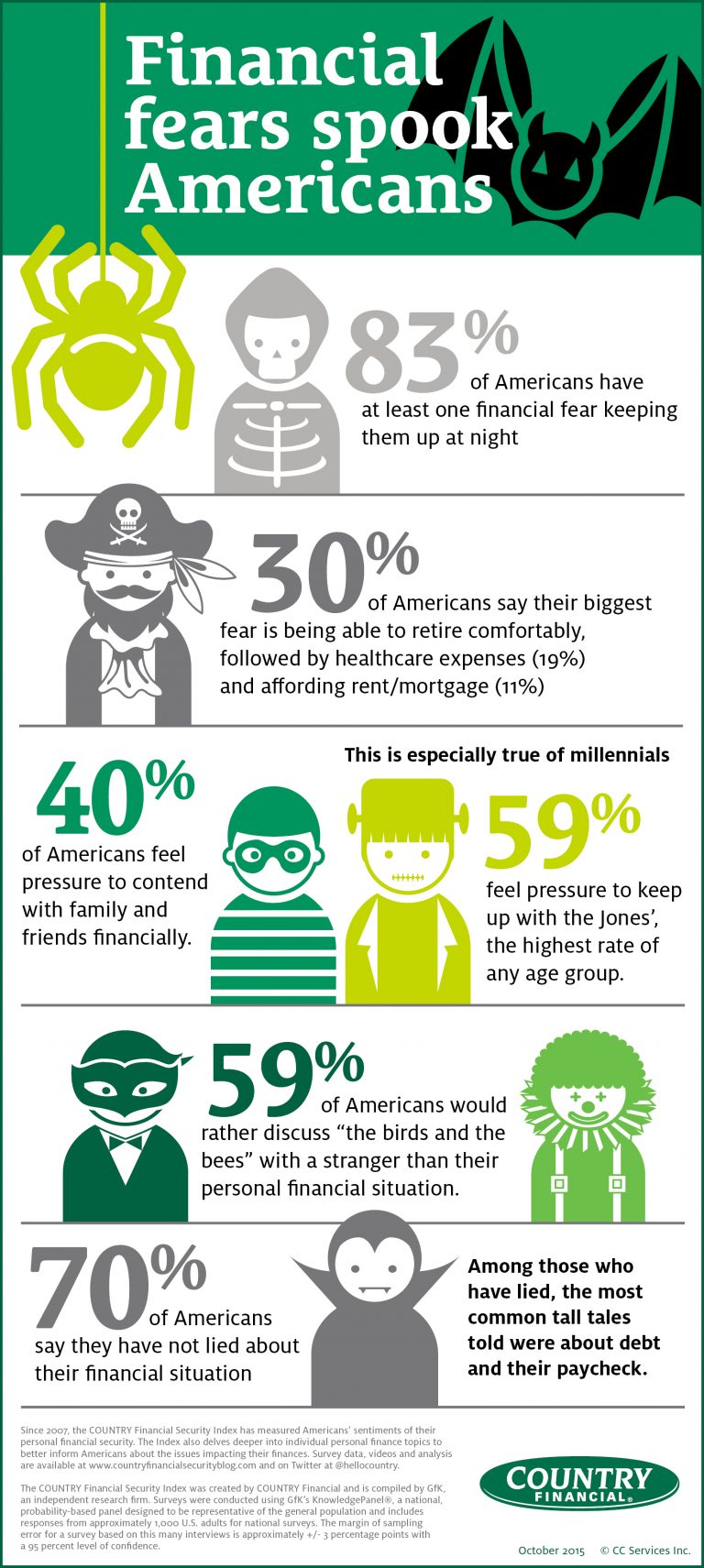

Retirement and Healthcare Costs Top List of Financial Fears

Money talk can be so scary that 59 percent of Americans would rather discuss "the birds and the bees" with a stranger than their personal financial situation (39 percent). This is especially true of women, as 63 percent share this preference compared ...

Thinking of Expanding Your Payroll Business? Consider Offering Benefits Administration Services

As you start evaluating your clients and current service offerings, consider ways you can provide additional services to clients, starting with existing clients.

How to Shield a Retirement Portfolio from Hitting Rock Bottom

Jittery investors saw the volatile market play havoc with investment portfolios. But while the ups and downs may have created anguish for some, financial planner Bryan S. Slovon says he fielded few if any calls from nervous clients.

How to Convert “Just Enough” to a Roth IRA

Generally, contributions to a traditional IRA may be wholly or partially tax-deductible, especially in the earlier part of your career, but distributions are taxed at ordinary income rates reaching up to 39.6 percent. In addition, you must begin ...

Why Florida Leads Nation in ID Theft Income Tax Refund Fraud: IRS Cracking Down

Florida has been in the news a lot recently, and probably not for reasons that promoters of the Sunshine State would prefer. The spotlight is because hundreds of people have been arrested over the past year for identity theft crimes that involved filing bogus income tax returns for thousands of taxpayers, and then having the refund checks sent to the criminal. And more than 33,000 Florida residents have claimed identity theft in the past year.

IRA Tax Strategies for Dealing with an Unpredictable Market

The stock market's drop in recent months has no immediate tax effect on the moneys of pre-retirement-age taxpayers whose traditional or Roth IRAs are invested in stocks and mutual funds. That's because neither losses nor gains are recognized within ...

4 Tips for Baby Boomer Retirement Planning

Most people have some kind of lifestyle vision for retirement. Unfortunately, without proper planning their dreams won’t always become a reality as they enter the encore time of their lives, says Michael Bivona, a CPA who retired almost 20 years ago.

5 Overlooked Variables in Retirement Planning

It wasn’t long ago that most Americans had a secure three-legged stool on which to rest their retirement concerns – a well-funded Social Security system, substantial corporate pensions with retiree health benefits and, ideally, a strong personal ...