Digital Currency

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Aliaswire Launches New Bank Account Validation Solution

The regulation was first announced by Nacha in March 2021 with a one-year grace period for compliance. As of March 19, 2022, ACH originators must use account validation as a “commercially reasonable fraudulent transaction detection system” to screen ...

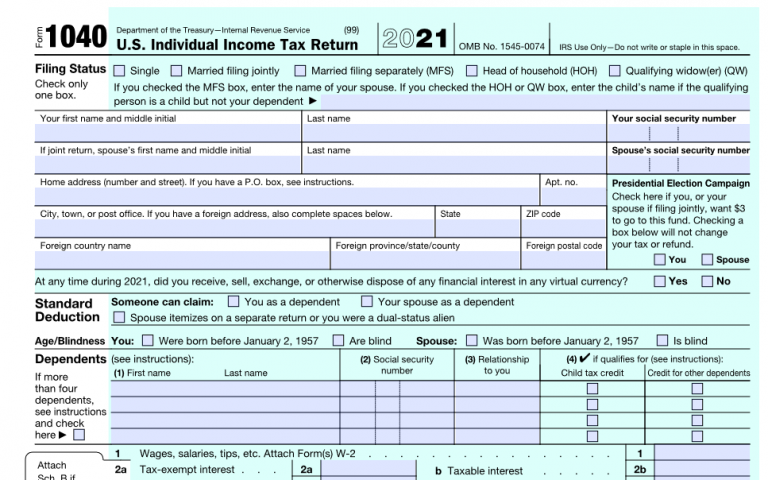

Taxpayers Should Take These Steps Before Filing Income Taxes

While taxpayers should not file late, they also should not file prematurely. People who file before they receive all the proper tax reporting documents risk making a mistake that may lead to processing delays.

![Max_The_Tax[1]](/wp-content/uploads/sites/2/2022/02/Max_The_Tax_1_.62006e6b8028e.png)

Surgent Launches Gamified CPE Courses to Make it More Fun

“Max the Tax” is the first series from “Surgent Interactive”, a new line of short, game-based online courses to keep accounting, tax and financial professionals engaged while they develop skills and earn CE credits.

Ledgible Announces Crypto Staking Tax Options in Light of Developments in Lawsuit Against the IRS

Ledgible, a professional platform for tax and accounting of crypto assets, has announced upcoming reporting options for staking rewards in light of the recent announcement concerning the lawsuit against the IRS over staking rewards, released by the Proof of Stake Alliance (POSA). “As there still remains differing positions around how staking rewards are taxed, Ledgible […]

The Top 10 Scams of 2021

In 2021, the median fraud loss reported to the NCL Fraud.org campaign hit a 10-year high of $800, according to the organization’s annual Top Ten Scams Report.

3 Cybersecurity Trends CPAs Must Address This Tax Season

Tax professionals need to account for shifting cybersecurity risks before a frenzied tax season captures their time and attention. Here are three cybersecurity trends that CPAs and accounting firms must address this tax season.

Verady Launches the Ledgible Crypto Platform

One of the biggest challenges for crypto holders and tax professionals is to account, track, and manage all the crypto data across multiple wallets and exchanges to calculate gains/losses and income. Holders do not receive monthly statements and this ...

States Look at Taxing the Metaverse, But What is It?

Sales transactions are presumed taxable in states with a sales tax (unless there’s a specific exemption or exclusion), most states haven’t yet clarified which sales tax laws apply to sales made in the metaverse. When will they start?