ESG

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Professionals on the Move – August 1, 2017

A roundup of professionals in the tax and accounting profession that have changed jobs and/or been promoted.

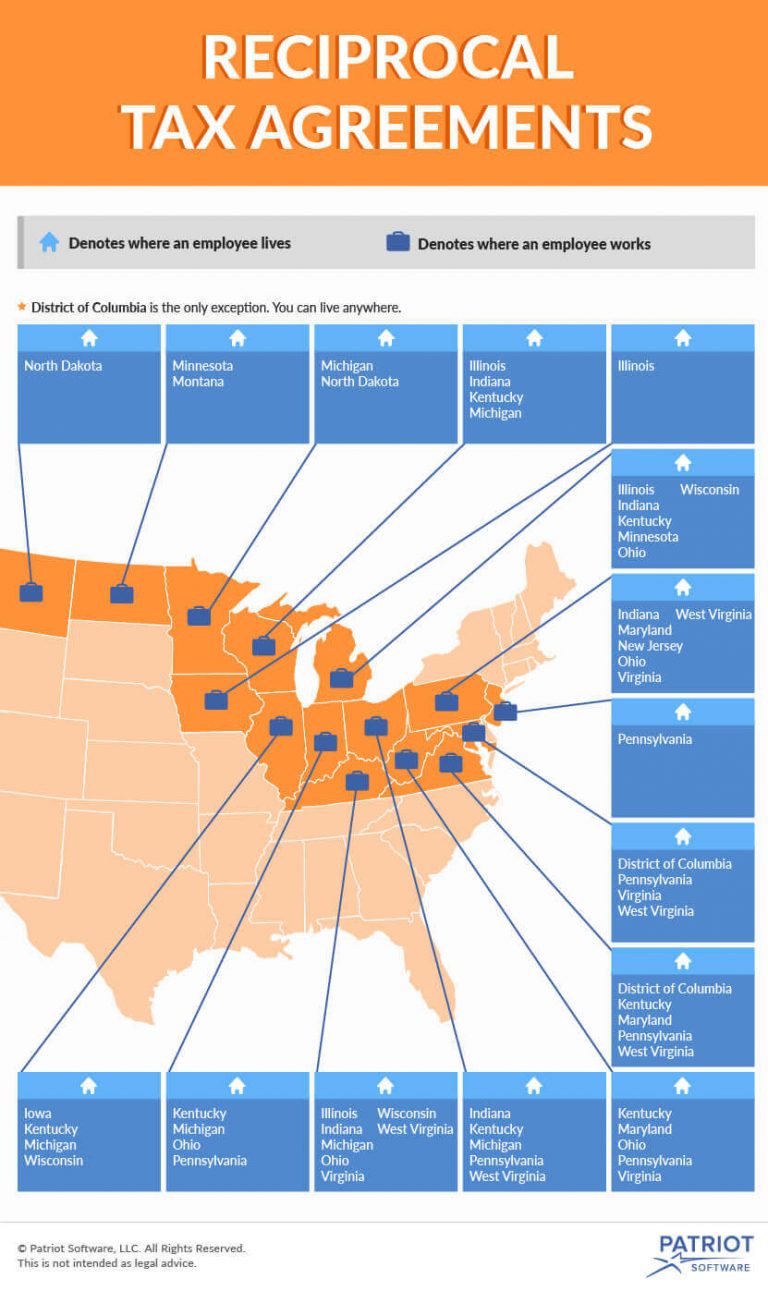

What is Tax Reciprocity?

Tax reciprocity normally applies to any wages an employee earns through employment: hourly wages, salaries, tips, commissions, and bonuses. Reciprocal tax withholding agreements between states usually do not apply to income earned outside of employment.

Financial Advisors Upbeat on Equities

Although concerned, advisors appear poised to capitalize on the opportunities volatility presents, with 54% saying volatility should be both managed to avoid losses and harnessed to take advantage of opportunities. However, their clients had a ...

New System Offers State Compliance Research for S Corps and Partnerships

Thomson Reuters has released Checkpoint State Clear Comply, which simplifies the analysis of complex state compliance questions for multi-tier partnerships and S Corporations with a presence in multiple states.

Execs Worry Over FATCA and CRS Compliance

More than 50 percent of senior executives from multinational financial firms are concerned non-compliance with the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) mandates could affect the reputations of their institutions.

2016 Review of Wolters Kluwer – CCH Axcess Tax

CCH Axcess offers a comprehensive, cloud-based suite of professional accounting and tax systems that utilize a singular database and can enhance firm productivity across multiple engagement types, and help firms standardize their workflow processes.

Midsized Businesses Struggling With Tax Compliance

The research revealed that nearly half of business owners do not know how many fines they incurred in the past 12 months or how much they cost their organizations.

Deloitte Gives $1 Million to SASB

Deloitte’s contribution to SASB is both financial and services-based. The financial commitment is in the form of $1 million in direct financial support over the course of four years, while the services-based commitment consists of in-kind support to ...