Financial Planning

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

U.S. Workers More Aware and Focused on Personal Finances

U.S. employees are more aware, focused, and motivated to improve their overall financial wellness, according to a new study.

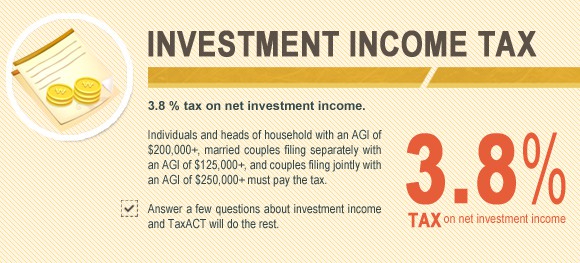

How the Net Investment Income Tax Can Bite Your Clients, and How to Get Them Prepared

If there is one thing that all CPAs can agree upon, it is that the 2014 tax return filing season was one of the most strenuous that any practitioner has seen in their career. Between rate increases, the imposition of new taxes, and the reinstatement of th

Five Financial Resolutions for 2015

Losing weight, eating healthy and hitting the gym more frequently tend to be popular New Year resolutions but this year, think about putting your finances first. According to Patrice C. Washington, the Money Maven of the Steve Harvey Morning Show, ...

IRS Increases 401k Limitations for 2015

The Internal Revenue Service has released the cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2015.

How’s Your Retirement Savings? More than Half of Americans Think They Won’t Have Enough

A new survey says more than half of working Americans over age 50 (55 percent) don't think they'll have enough money for health care as they reach the age they expect to retire.

Consumers and Retailers Increasingly Using Coupons

Americans love a deal, and despite the increasingly digital economy, they still rely on coupons, according to a new study shows that reports that 96 percent of Americans are coupon users.

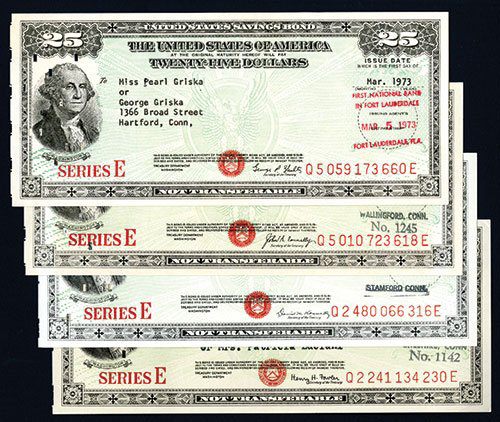

Clever Financial Strategy For Reporting Interest Earned On U.S. Savings Bonds

Currently over 50 million individuals own nearly $178 billion worth of U.S. Savings Bonds. Many don’t realize that savings bonds are subject to federal income taxes when they are either cashed in or reach final maturity, whichever comes first. The difference between the purchase price and the cash-in value is considered reportable interest. When savings bonds are cashed in, a 1099-INT is normally issued for any interest earned amount over $10. Savings Bonds are free from state and local taxes.

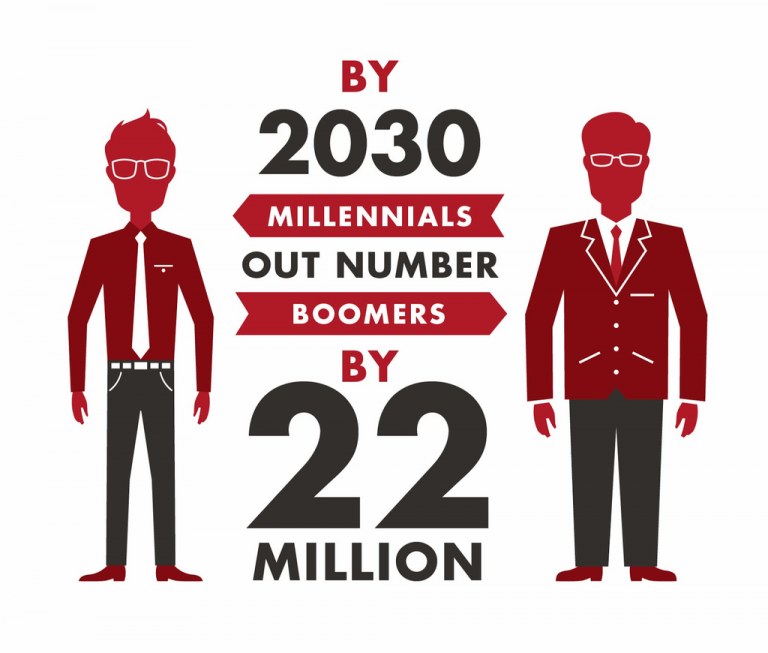

Most Millennials Wish They Were Better Prepared Financially, 1/4 Under Extreme Financial Stress

TD Bank survey finds most millennials wish they were better prepared for life events.