Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

![menu-banner-mobile[1]](/wp-content/uploads/sites/2/2020/05/menu_banner_mobile_1_.5ebac330117ae-768x396.png)

Accounting Firm Marcum and BurgerFi Partner to Deliver 20,000 Meals to Hospital Workers

Up to 20,000 meals are planned to be distributed over a two-week period culminating with drops at select VA Hospitals throughout the U.S. caring for Covid-19 cases on Memorial Day, May 25.

Why Didn’t You Receive Full IRS Coronavirus Stimulus Payment?

Some Americans may have received a payment amount different than what they expected. Payment amounts vary based on income, filing status and family size.

IRS Sent Coronavirus Stimulus to Millions of Dead and Incarcerated Persons

The IRS has sent Coronavirus stimulus payments to deceased people by mistake. It’s unclear how many such checks have been delivered, but it’s thought to be significant, because about 2 million people in the U.S. die each year.

IRS Sees Dead People With Stimulus Checks

The IRS has discovered that it has mailed checks to deceased people by mistake. It’s unclear how many such checks have been delivered, but it’s thought to be significant, because about 2 million people in the U.S. die each year.

Tax Deadline Could be Extended to Sept. 15 (Or even Dec. 15)

Although talks within the Trump administration are still in the preliminary stage, NBC news has reported that the deadline could be postponed again to September 15—or even as late as December 15.

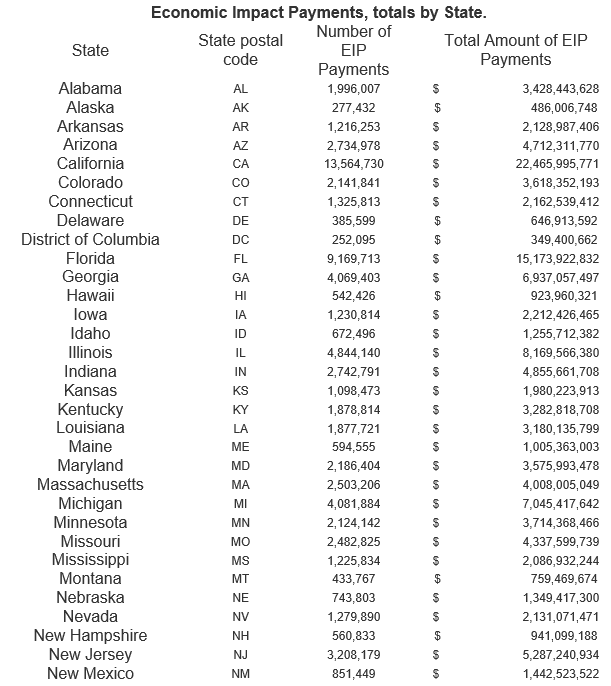

IRS Releases State-by-State List of Coronavirus Stimulus Payments

The Treasury Department and the IRS have released updated state-by-state figures for Economic Impact Payments, with approximately 130 million individuals receiving payments worth more than $200 billion in the program’s first four weeks. (Up through May 8)

Loan Forgiveness Rules Under the Paycheck Protection Program and Next Steps

You already play a key role in advising your clients on their taxes, so spend the extra time to advise on how to keep track of their PPP loans. Spending time on the front end setting up the recordkeeping and processes will save a lot of time in the ...

3 Tax Credits for Businesses Impacted by Covid-19

The employee retention credit is designed to encourage businesses to keep employees on their payroll. The refundable tax credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19.