Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

TurboTax Promises Refunds to Oregon Filers Whose Returns It Bungled

TurboTax recommended some Oregon filers take the standard state tax deduction even though they'd save more money itemizing.

IRS: No Change in Tax Interest Rates for Q3 2024

Starting on July 1, the rate for overpayments and underpayments for individuals will be 8% per year, compounded daily.

Most Tax Pros, Corporate and Public, Believe AI Should Be in Their Toolbox

77% of tax professionals believe AI technology can be applied to their work, and 56% of in-house corporate tax teams think their external tax advisers’ firms should be using AI.

U.S. Corporate Taxes Likely to Rise to Tame Deficit, Buffett Says

Higher taxes are "quite likely," the Berkshire Hathaway chairman and CEO said, as Washington prepares for major tax discussions next year.

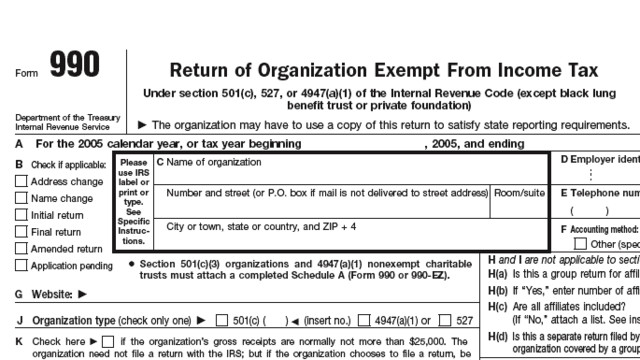

The Next Tax Deadline is May 15 for Tax-Exempt Orgs

While the April 15 tax deadline for most Americans to file their individual annual tax returns has passed, there are several deadlines each year, some for individuals, businesses, nonprofits and even organizations that are tax-exempt.

More Rich Americans Will Soon Be Hit With an IRS Audit, Werfel Pledges

But the IRS chief emphasized once again that audit rates won't increase for small businesses and taxpayers making under $400,000.

IRS: Applications For TCE and VITA Grants Can Be Submitted Through End of May

The funding helps organizations provide free tax assistance to elderly and low-income taxpayers for up to three years.

‘Bitcoin Jesus’ Charged With Evading Nearly $50 Million in Taxes

Roger Ver was charged with mail fraud, tax evasion, and filing false returns in order to avoid paying at least $48 million in U.S. taxes.