Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

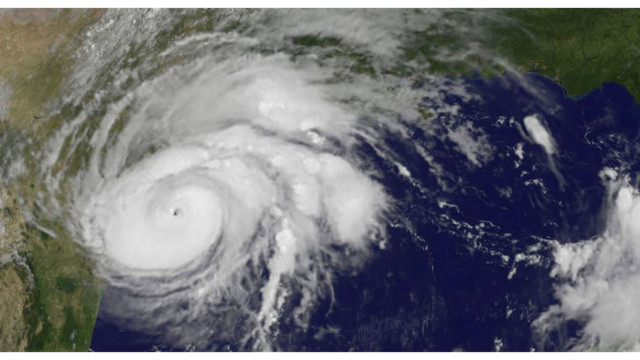

IRS Offers Tax Deadline Extensions for Louisiana Due to Hurricane Francine

These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments.

IRS Issues Proposed Regs for New Corporate Alternative Minimum Tax (CAMT)

The proposed regulations provide definitions and general rules for determining and identifying AFSI. They also include rules regarding various statutory and regulatory adjustments in determining AFSI.

Colorado Set to Join IRS Direct File Program in 2026

Coloradans will soon be able to file their federal income taxes online for free under a program created by the Inflation Reduction Act.

Bloomberg Tax Predicts 2025 Standard Tax Rates, Standard Deductions, and AMT

Bloomberg Tax's annual Projected U.S. Tax Rates Report provides early, accurate notice of the potential tax savings that could be realized due to increases in deduction limitations, upward adjustments to tax brackets, and increases to numerous other key thresholds.

What Trump and Harris Said About Tariffs and Taxes During Debate

The two presidential candidates attacked each other on the economy, taxes, immigration, and abortion, among other issues.

IRS Extends Some Tax Filings For New York, Connecticut Flood Victims

Impacted residents and business owners have until Feb. 3, 2025, to submit a variety of tax filings and payments.

Third Estimated Tax Payment Due Sept. 16, IRS Says

Individuals and businesses affected by disasters in 17 states, Puerto Rico, and the Virgin Islands may qualify for an extension.

IRS-CI Urges Sports Bettors to Play By the Rules This Football Season

Between FY 2020 and June 2024, IRS-CI initiated 151 investigations into illegal gambling activity totaling more than $178.8 million.