Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

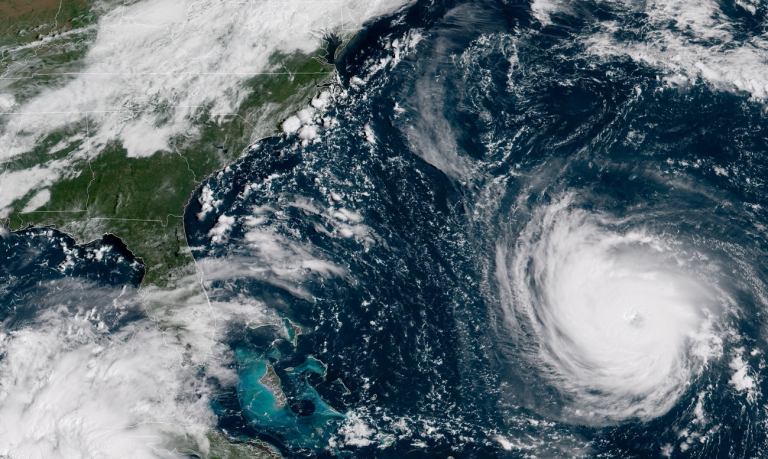

U.S. Taxpayers in Puerto Rico Get Relief Due to Tropical Storm Ernesto

These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments. The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA).

New Jersey Drivers Could Write Off Their E-ZPass Tolls if Bill is Passed

If approved and signed in to law, New Jersey would extend a benefit to taxpayers that few states have and the IRS doesn’t allow.

IRS Highlights New Payment Options Within Business Tax Account Tool

Business tax account was launched last October as part of the agency's service improvement initiative under the Inflation Reduction Act.

Study: Charitable Giving Dropped By $20 Billion in First Year of TCJA

The researchers say that charitable giving fell in 2018 because of the law's change to the standard deduction for income taxes.

Interest Rates to Stay Unchanged for Q4 of 2024, IRS Says

Starting on Oct. 1, the rate for tax overpayments and underpayments for individuals will be 8% per year, compounded daily.

New Tax Industry Task Force Aims to Crack Down on Scams

The Coalition Against Scam and Scheme Threats is comprised of the IRS, state tax agencies, tax software firms, associations, and others.

Harris Calls For 28% U.S. Corporate Tax Rate

The Democratic presidential nominee's plan is in line with the corporate tax rate the Biden administration proposed in March.

What’s All the Fuss About Tips and Taxes?

Both presidential candidates are pledging to exempt workers from paying taxes on their tips, but experts say it's bad policy.