Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

This Retirement Plan Is Just for Self-Employeds

You can adopt either a defined contribution Keogh plan or a defined benefit Keogh plan. As you might expect, the rules for these variations generally

The Independent Contractor Dilemma

Gig economy companies classifying their workers as independent contractors continue to face lawsuits, state action, and federal agency enforcement

Accounting Firm Saved Clients More Than $1 Million in Taxes from 2019-2021

According to SideHustle.com, 45% of Americans (70 million people) report having a side hustle. Among millennials, that number rises to 50%, while 70% of Gen Zs reported looking for a side hustle.

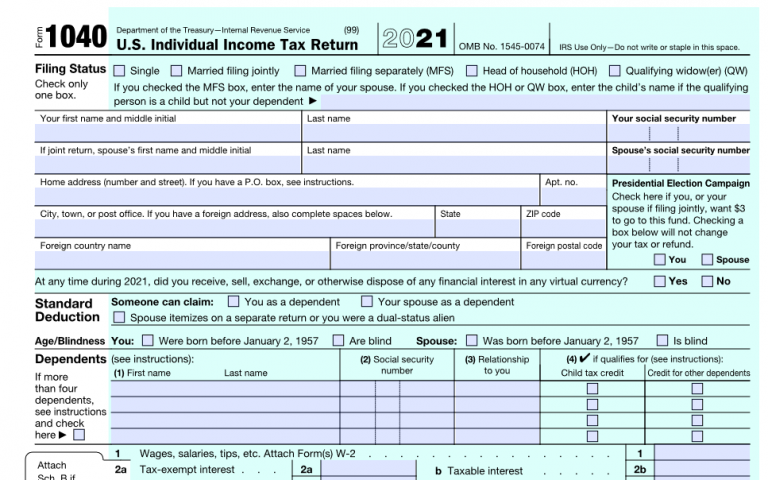

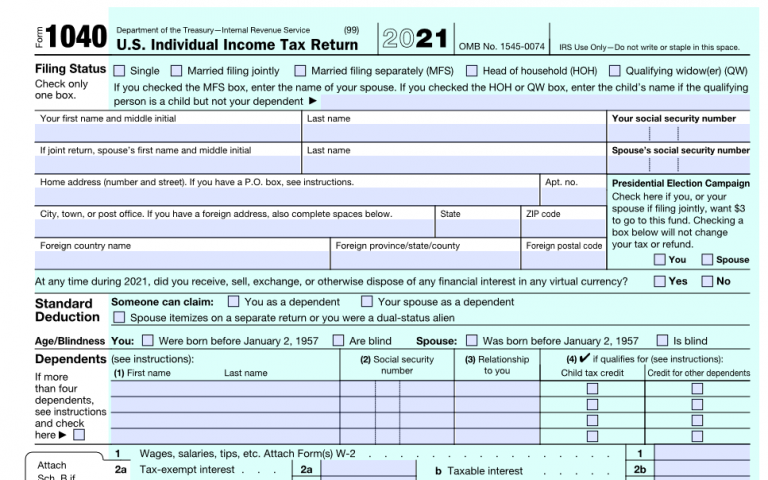

Georgia Says Embryos are Dependents for Tax Purposes

The state of Georgia's taxation department has announced that taxpayers can claim fertilized embryos as dependents for tax purposes.

The Evolution of Nexus and its Implication for Income Tax

Although Wayfair was strictly a sales tax case, states have also begun to assert economic nexus for income tax purposes. Unlike sales tax, currently only a handful of states...

FASB to Review Accounting For Environmental Credit Programs

The Financial Accounting Standards Board (FASB) recently decided to tackle a project that could result in new rules being created on how companies should account for environmental credits, such as renewable energy credits and carbon offset credits.

Taxpayers with Balances Due Have Been Put on Notice By the IRS

The CP14, which is required by law to be issued within 60 days after the IRS assesses a tax liability, is the most common IRS notice sent to taxpayers, according to the Taxpayer Advocate Service, and requests payment within 21 days. The reason why taxpayers have a balance due can be related to a number of issues, such as failing to report some income or failing to pay a balance in full, Tiffany Gonzalez, CPA, CEO of Miami-based accounting firm Accounting to Scale, stated last week on LinkedIn.

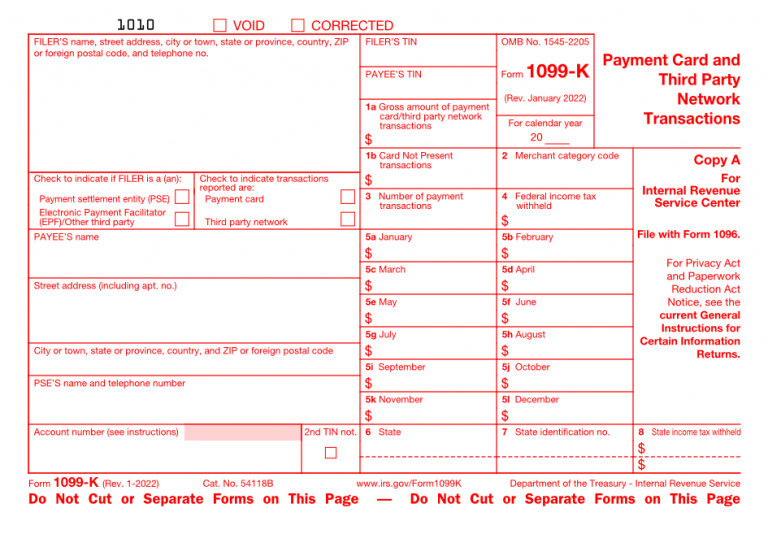

Are You Ready for New 1099-K Rules?

It used to be that receiving a Form 1099-K was relatively rare. The form, technically known as Form 1099-K Payment Card and Third-Party Network Transactions was used to report payments received from various third-party resources. Prior to 2022, the monetary threshold to receive a 1099-K was $20,000, with 200 sales-related transactions required. Both requirements had to be fulfilled in order to receive a 1099-K.