Payroll

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Older Americans Are Fairly Well Off, Says Census Bureau

Among householders aged 65 and over, the median income was estimated to be 27% higher than in the bureau’s last analysis.

Tax Season Best Practices to Avoid Identity Fraud – 2023

To fight identity fraud and cybercrime, tax preparers and filers must collaborate and adopt effective methods to secure their data and financial resources.

U.S. Companies Anticipate Increased Hiring in the First Half of 2023

58% of respondents anticipate adding new permanent roles during the first half of the year, up from 46% six months ago. Another 39% expect to hire for vacated positions.

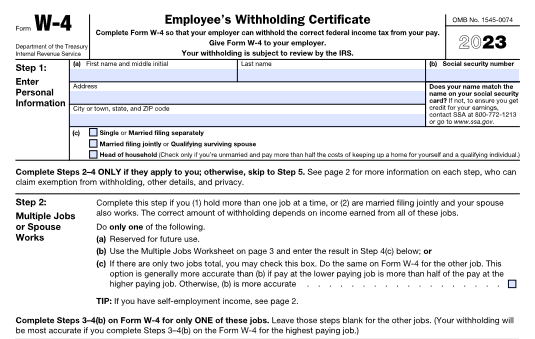

IRS Makes Minor Changes to 2023 W-4 Form

If you know Form W-4 like the back of your hand, knowing these 2023 changes should be enough to close out this article and go about your day.

New Law Encourages Roth 401(k) Accounts

For 2023, a participating employee can contribute up to $22,500 in elective deferrals or up to $30,000 if they are age 50 or over.

The Impact of AI on the Accounting Profession

In late 2022, a new AI tool, called ChatGPT, exploded into the marketplace. Since then, it’s been mentioned in hundreds of online articles, in chatrooms, and in the media.

Creating an Employee-First Culture

When employees feel valued, respected, and supported by leadership, your firm builds and sustains trust in its talent.

How the Tax Code Can Help Investors Keep Their Real Estate Wealth Stable During Retirement

To leverage a 1031 exchange, an investor has to ensure the income from a real estate investment property sale is reinvested (or “exchanged”) in like-kind property.