State and Local Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Accounting Firm Introduces Use Tax Compliance System

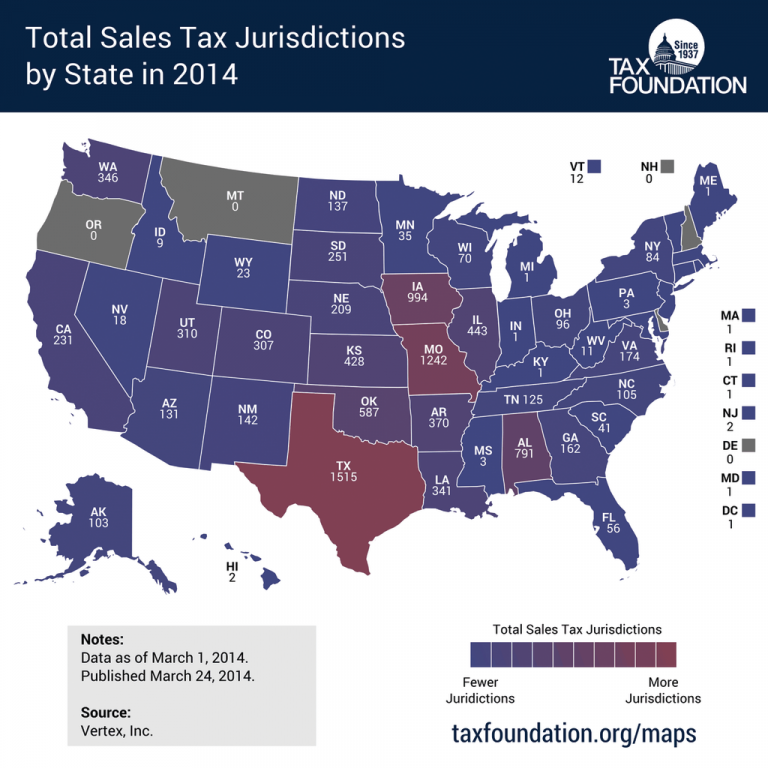

Crowe Horwath LLP, one of the largest public accounting and consulting firms in the U.S., has introduced the Crowe Use Tax Simplifier, a tool that facilitates the use tax verification process.

Should Taxpayers Deduct State Income Tax or State Sales Tax?

The optional sales tax deduction is a no-brainer for some individual taxpayers. If you live in one of the seven states with no state income tax – Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming -- you should elect to deduct your ...

State Deadlines Near for Forms W-2 and 1099

The deadlines for businesses to send forms W-2 and 1099 copies to individual states are quickly approaching, with the majority of states having a March 2 deadline date. The various state rules and regulations can be daunting, as state filing varies ...

State & Local Tax Highlights from Around the Country – Feb. 2015

State and local taxes are constantly changing. As the most trusted financial and business advisor to your clients, it's your job to keep up with them. At CPA Practice Advisor, we're here to help you - so here's a roundup of some of the latest changes.

Puerto Rico Is Turning Into a Tax Haven for Americans and Businesses

If you move to Puerto Rico, you can retain your U.S. citizenship while saving taxes, not an option in some other so-called tax havens. Although the tropical island is just a little more than 1,000 miles from Florida, it might as well be halfway around ...

How and When to Make Sales Tax Payments

If you or your clients are new to collecting and paying sales tax, the process might seem overwhelming. Once you have determined that taxable sales are occurring, the next step is to prepare yourself for being a sales tax collector and remitter.

National Average Sales Tax at 5.45%, While 201 Localities Changed Indirect Tax Policies

While the average U.S. sales tax rate remained unchanged in the fourth quarter, the number of indirect tax changes increased from the previous quarter, according to the latest ONESOURCE Indirect Tax report from Thomson Reuters.

Sales Tax Is About to Take Center Stage

Once the elections are over, we expect Congress will finally get busy focusing on sales tax legislation. But that's only part of the excitement here at the magazine. It's that time of year when accountants have a bit of time to spare before they ...