State and Local Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Supreme Court to Hear Maryland Case on State Double Taxation

On January 28, 2013, the Maryland Court of Appeals found an important element of the Maryland income tax unconstitutional. The controversy surrounds the state’s disallowance of credits against the Maryland county-level income tax for taxpayers who pay income tax to other states. The US Supreme Court has agreed to hear the state Comptroller’s appeal in its next term. The Case was Maryland State Comptroller of the Treasury v. Wynne, No. 107.

2014 Review of Sales Tax Systems for Small Businesses

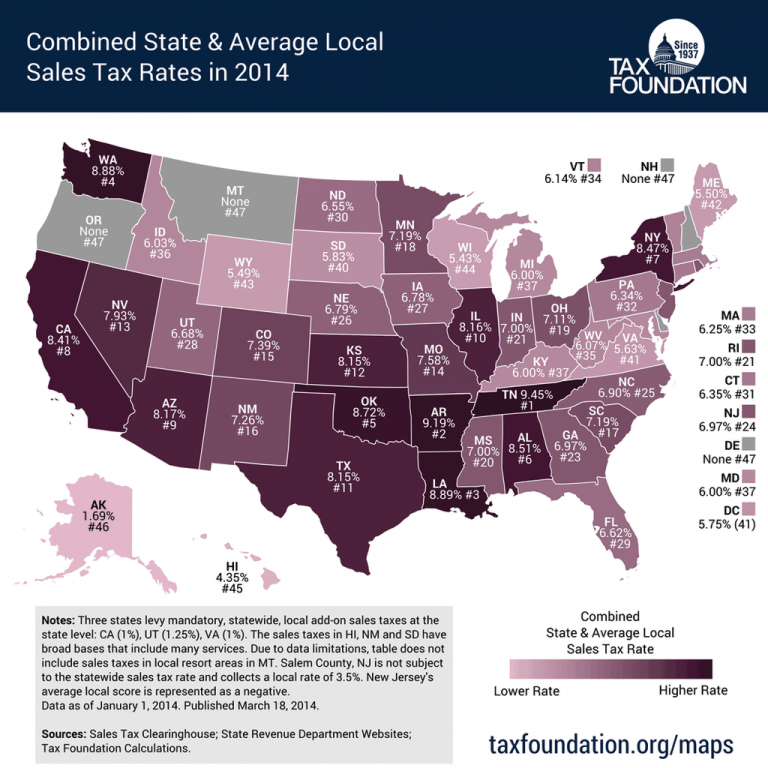

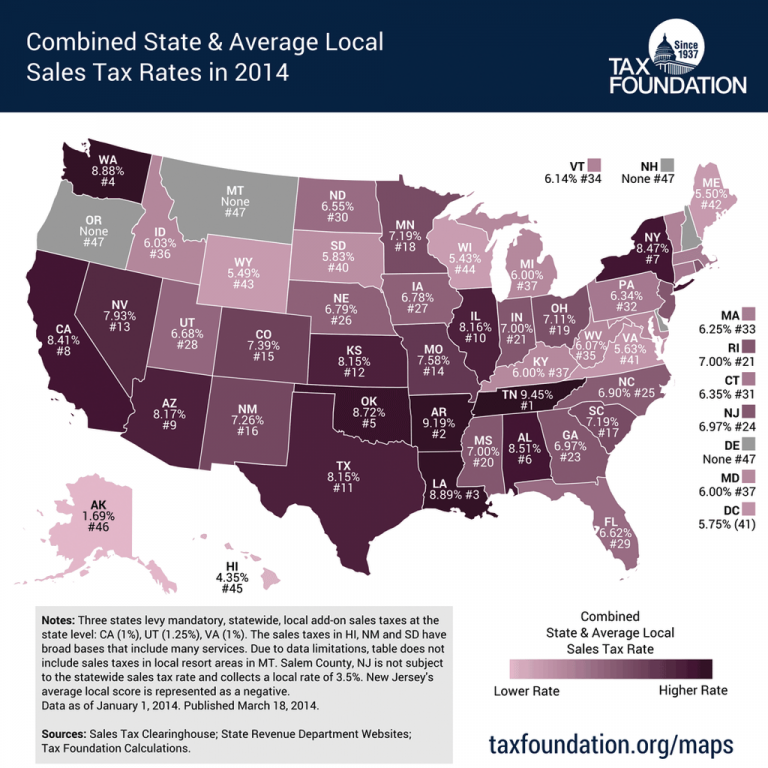

Sales and use tax is a key source of government funding in most states. Unlike property tax and state income tax, however, the legislators and regulators have adopted a patchwork of different rules which affect the taxability of the items. In addition to dealing with statewide tax rates in 45 states, 38 states levy sales taxes based on the borders of cities, counties, and special districts.

Talking to Your Clients About SALT

The Year in the Life of a State and Local Tax (SALT) Accountant series is being created with the practitioner in mind. In cooperation with Avalara, each month we'll provide you with the latest news relating to state and local tax issues, updates on federal legislation, checklists and tips for building and improving your SALT practice, talking points and guidance for answering the questions posed by your clients, and more.

SALT and Summer Reading

When I started my accounting career as a Deloitte tax accountant, we were each expected to choose a niche. I wanted to focus on agriculture clients, but it seemed the Chicago area didn't provide enough to keep me busy in that area, so instead I found myself getting the small business clients, and in particular, […]

Sales Tax & Compliance

The Sales Tax & Compliance series is being created with the practitioner in mind. In cooperation with Avalara, each month we'll provide you with the latest news relating to state and local tax issues, updates on federal legislation, checklists and ...

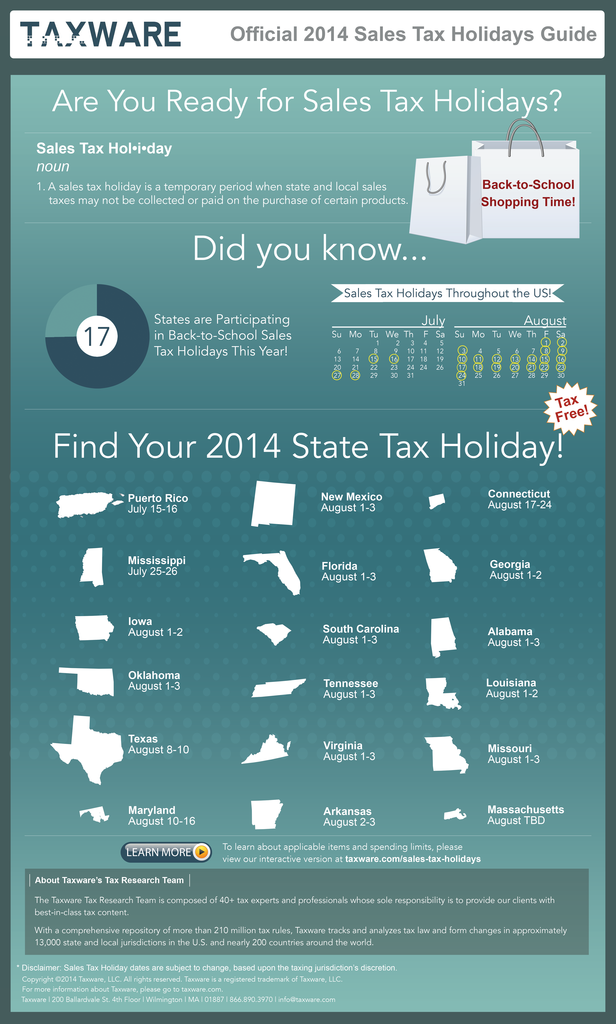

Infographic Shows Sales Tax Holidays Across U.S.

Sales tax compliance is one of the most volatile issues that many businesses have to deal with, with more than 8,000 taxing jurisdictions across the country. From the state and county-level, to cities and special purpose zones like metro transit authorities.

Payment System BlueSnap Partners with Avalara for Sales Tax, VAT

Global payment gateway BlueSnap today announced an integration with Avalara, a leading provider of cloud-based software that delivers a broad array of compliance solutions related to sales tax, VAT and other transactional taxes.

Alliance Focuses on Helping Accounting Firms with State and Local Taxes

State and local taxes are a complex web of thousands of jurisdictional rules, and it isn't Charlotte waiting at the end of the web. Instead, there are revenue hungry state and local taxing authorities who are looking for back taxes, penalties and interest.