State and Local Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Proposal would exempt family businesses from Pennsylvania inheritance tax

The state's inheritance tax can leave heirs scrambling to cover a tax bill. And many end up selling the business or taking out costly loans.

Virginia unemployment insurance taxes to dip

Taxes for the Virginia unemployment insurance benefits are set to decline this year for the first time since the recession hit.

Payroll tax would elicit some cash from large Pittsburgh nonprofits

State Sen. Jim Ferlo added a new wrinkle Monday to the debate about whether nonprofits in Pittsburgh should pay for public services when he proposed a 0.4 percent payroll preparation tax.

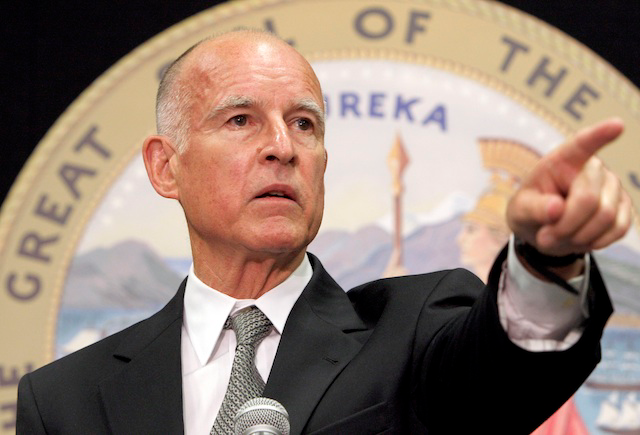

California reports budget surplus

After more than a decade of financial strife, teacher cutbacks, employees paid with IOUs and the recall of one governor, California Governor Jerry Brown unveiled the state's latest finances. The surprise for many: A budget surplus of about $851 million.

Virginia proposal complicates Maryland’s gas tax debate

The governor of Virginia has thrown a new wrinkle into a Maryland debate by calling for abolition of the commonwealth’s gas tax and increasing the sales tax to pay for roads and transit, a move that would alter the competitive balance between the two states. This week’s proposal by Gov. Bob McDonnell, a Republican, is […]

Tax ‘simplification’ in Arizona could cause havoc for some towns

Some cities and towns in southern Arizona say the recommendations by the Arizona Tax Simplification Task Force could them millions of dollars.

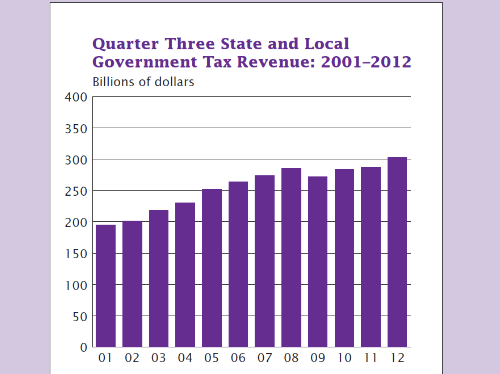

State and local tax revenues up across U.S.

Summary of State and Local Government Tax Revenue: 3rd Quarter 2012

Harlingen, Tex., sees sales tax dollars increase nearly 20 percent

The Texas Comptroller of Public Accounts says that Harlingen will receive $1,696,146, up 19.47 percent from this time last year. The numbers, reported this month, are based on revenues collected in October.